Capitalization Rate, or Cap Rate for short, is the rate which your capital is returned after the first year.

Understanding Cap Rate in Real Estate Investments

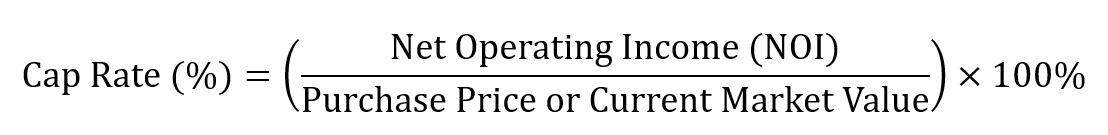

The Capitalization Rate, commonly known as the Cap Rate, is a crucial metric in the real estate industry used to estimate the potential return on an investment property. It represents the ratio of the Net Operating Income (NOI) to the property purchase price or its current market value. The Cap Rate is expressed as a percentage and gives investors a quick glance at a property’s potential to generate income, helping to assess its profitability in comparison to other investment opportunities.

The Cap Rate Formula

The formula to calculate the Cap Rate is quite straightforward and is defined as follows:

Using the values in our example, the Cap Rate would be calculated like so:

Utilizing Net Operating Income (NOI) in Cap Rate Calculations

Net Operating Income, a cornerstone in determining the Cap Rate, is the total income generated from a property minus the total operating expenses. It is pivotal to have a precise NOI figure to get an accurate Cap Rate.

Determining Property Value Using Cap Rate

Besides calculating the potential return rate, you can use the Cap Rate to find out the estimated market value of a property if you know its NOI and the prevalent Cap Rate in the market. The formula is given by:

So, using an NOI of $19,938 and an 8% Cap Rate, the market value would be:

Conclusion

Understanding and accurately utilizing the Cap Rate is indispensable for investors in the real estate industry. It not only helps in making informed decisions about potential investments but also aids in determining the market value of a property, ensuring that you make judicious investment choices based on comprehensive analyses.