Configure your default financial model assumptions and loan details for accurate forecasting and investment analysis.

Making smart real estate investment decisions starts with accurate data modeling. Rescover allows you to tailor your financial parameters and performance hurdles to match your unique investment strategy. This guide will walk you through the nitty-gritty of customizing your financial model assumptions and loan details, ensuring that you can evaluate deals through a lens that’s personalized for your needs.

Accessing Investment Parameters

To begin, navigate to the user menu where it says "Welcome, Your Name" and select "Investment Parameters."

Table of Contents

- Customizing Closing Costs

- Fine-Tuning Loan Details

- Down Payment

- Interest Rate

- Amortization Period

- Loan Fees

- Interest-Only Loan Options

- Management Expenses and Vacancy Settings

- Monthly Management Percentage

- Vacancy Assumptions

- Maintenance and Capital Expenditures

- Maintenance Expense

- Capital Expenditures

- Leasing and Resale Expenses

- Lease Commission

- Lease Renewal Fee

- Cost of Sale

- Inflation and Appreciation

- Annual Rental Rate Increase

- Annual Expense Inflation

- Annual Property Appreciation

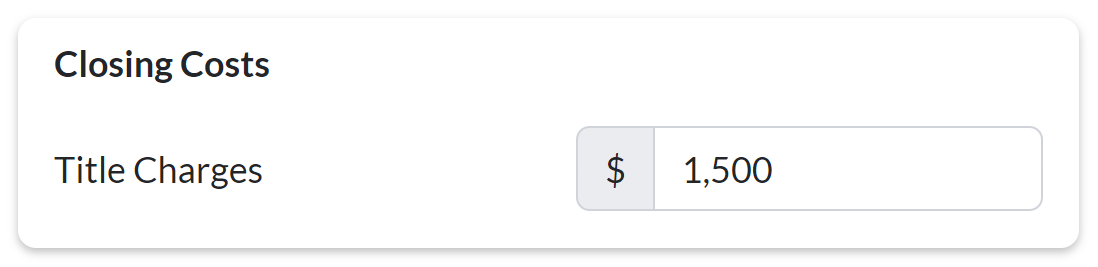

Closing Costs

Closing costs are the one-time fees associated with purchasing a property. As a buyer you can expect to pay for an escrow fee, document prep and recording charges, an inspection, and other miscellaneous fees. Adjust this amount to more accurately reflect your typical investment scenario.

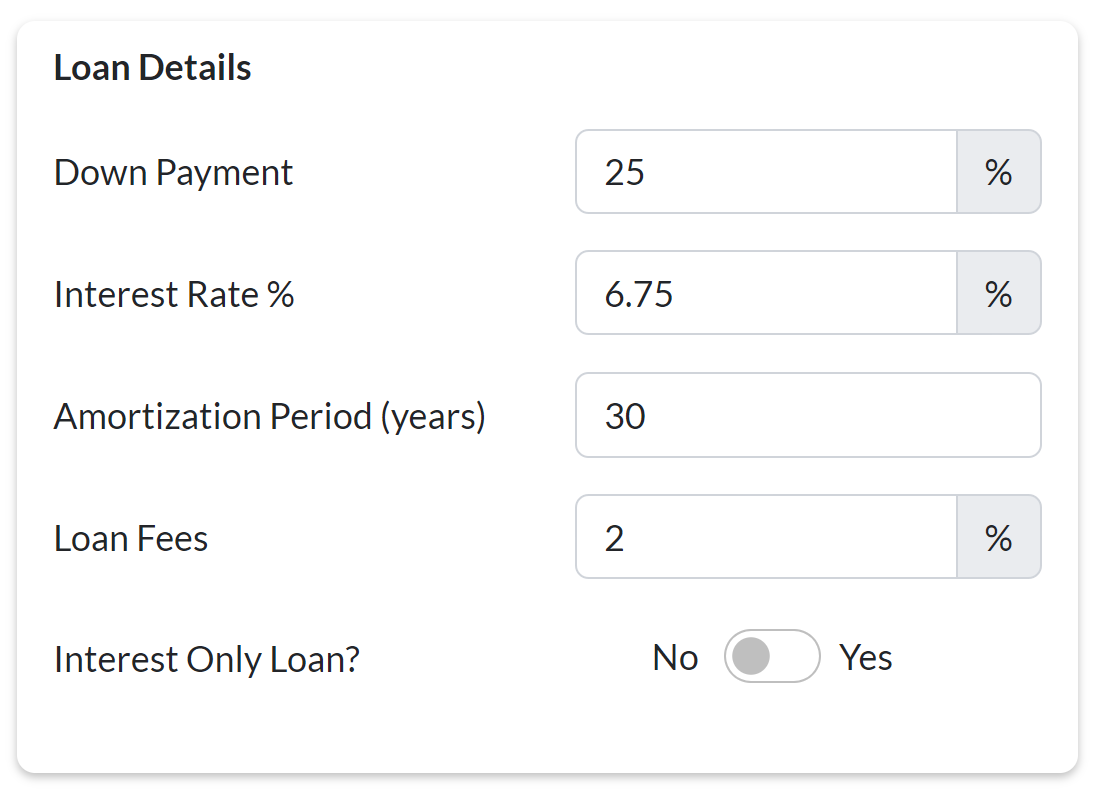

Fine-Tuning Loan Details

In this section, you'll be able to customize various loan-related settings to better align with your investment strategy and available financing options.

Down Payment

The down payment is the initial amount you'll be paying upfront for the property. Adjust this percentage to match your financial capabilities and investment strategy.

Interest Rate

The interest rate impacts your monthly mortgage payments and overall ROI. Make sure to adjust this according to current market rates or the rate you've been quoted.

Amortization Period

This is the number of years it'll take to fully pay off the loan. A longer period means lower monthly payments, but more interest over time. Set this according to your long-term financial plans.

Loan Fees

Loan fees include any additional charges imposed by the lender. These could include origination fees, underwriting fees, and more. Enter the percentage based on what your lender is charging you.

Interest-Only Loan Options

Interest-only loans require you to pay just the interest for a certain period, delaying principal payments. This could be useful for certain investment strategies but understand the risks involved. If you select yes, an additional drop-down field will appear which allows you to choose the length of interest-only period for your loan.

Management Expenses and Vacancy Settings

This section allows you to account for the day-to-day operational costs and potential downtime associated with property management.

Monthly Management Percentage

This is the fee you'd pay to a property manager, often calculated as a percentage of the monthly rent. Adjust this according to what you'd typically pay for management services. If you manage the property yourself, you may set this to zero.

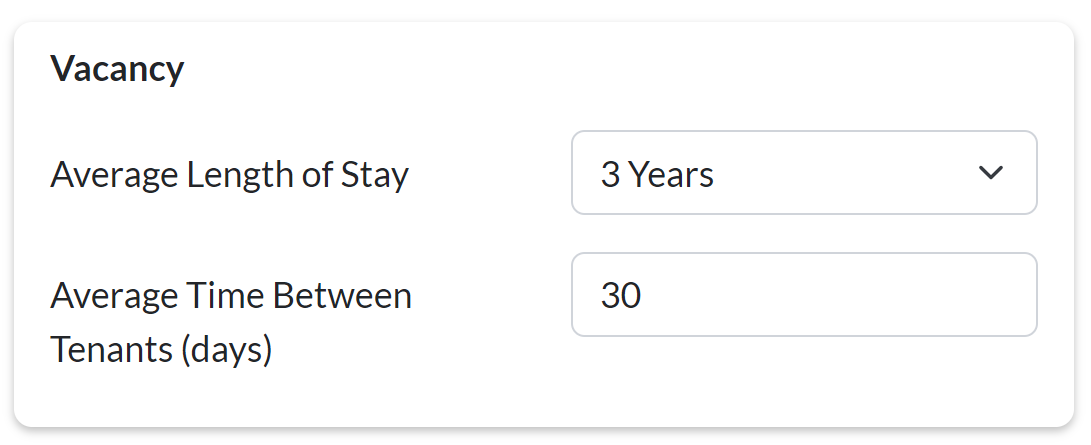

Vacancy Assumptions

Vacancy can have a significant impact on your investment returns. In this section, you can specify:

- Average Length of Stay: The number of years you expect a tenant to occupy the property.

- Average Time Between Tenants: The number of days you anticipate the property will be vacant between tenants.

Adjust these settings to align with the market conditions and your past experiences for a more accurate financial model.

Maintenance and Capital Expenditures

Owning a property involves more than just collecting rent—you also have a responsibility to maintain the property. This section allows you to budget for those costs as a percentage of your gross rent.

Maintenance Expense

Set this as the percentage of your gross income that you anticipate spending on regular, ongoing maintenance. The appropriate percentage may vary based on factors like the age and condition of the property or properties you're evaluating.

Capital Expenditures

Also known as CapEx, these are larger, less frequent expenses such as a new roof or HVAC system. Like maintenance expenses, you'll set this as a percentage of gross income. Budget for this based on the long-term improvements or replacements you expect will be needed over time.

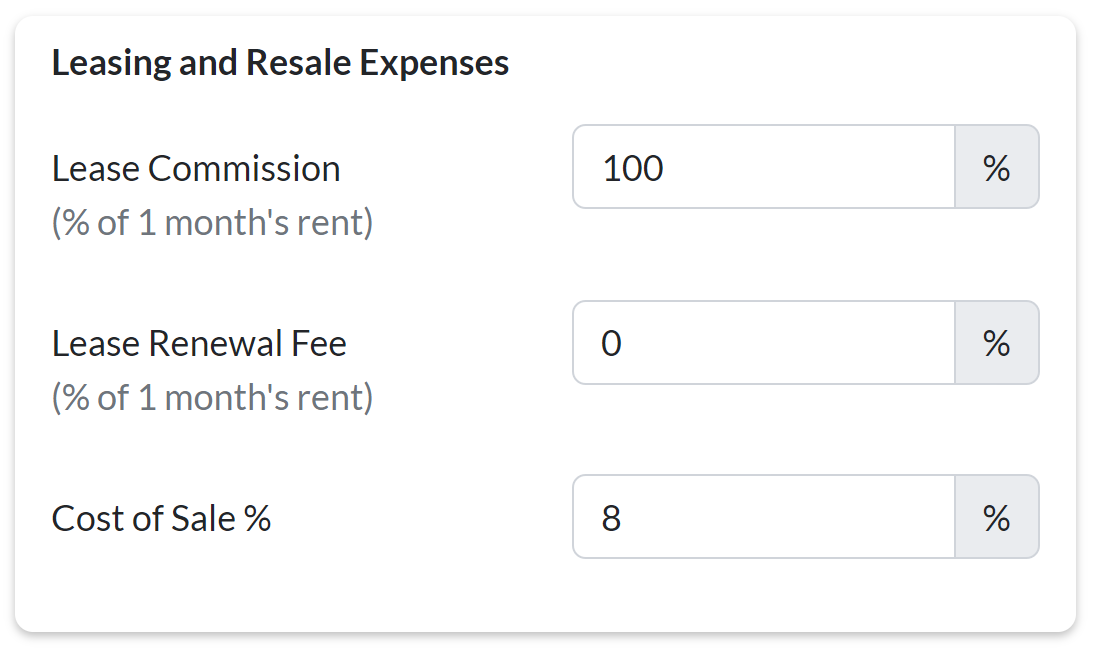

Leasing and Resale Expenses

When you own a property, you'll likely have to incur costs during the leasing process or when it comes time to sell. This section helps you account for those expenses.

Lease Commission

This represents the percentage of the first month's rent that you'll pay as a commission to a leasing agent or broker. Adjust this percentage based on the market rate or any deals you've negotiated.

Lease Renewal Fee

Some property managers or leasing agents charge a fee for renewing a lease with an existing tenant. This field lets you set that as a percentage of one month's rent. Set this to zero if you typically don't incur this expense.

Cost of Sale

When you decide to sell the property, there are a variety of expenses such as agent commissions, closing costs, and more. Enter the expected percentage of the sale price that you anticipate will go toward these costs.

Inflation and Appreciation

Investing in real estate is a long-term game, and this section allows you to account for economic factors that can influence your investment over time.

Annual Rental Rate Increase

This percentage represents how much you expect the rent to increase each year. Use this setting to forecast potential growth in rental income over the investment period.

Annual Expense Inflation

Expenses tend to rise over time due to inflation. This setting allows you to predict how much your property's operational costs might increase annually.

Annual Property Appreciation

Property values typically grow over time, and this setting lets you factor in that appreciation. Set the annual percentage growth based on market trends or your own expectations.