How to Analyze Existing Investments

Do you already own the house you want to analyze? Does it have an existing loan? Have you or are you thinking of turning it into a rental? Follow this guide to setup your analysis.

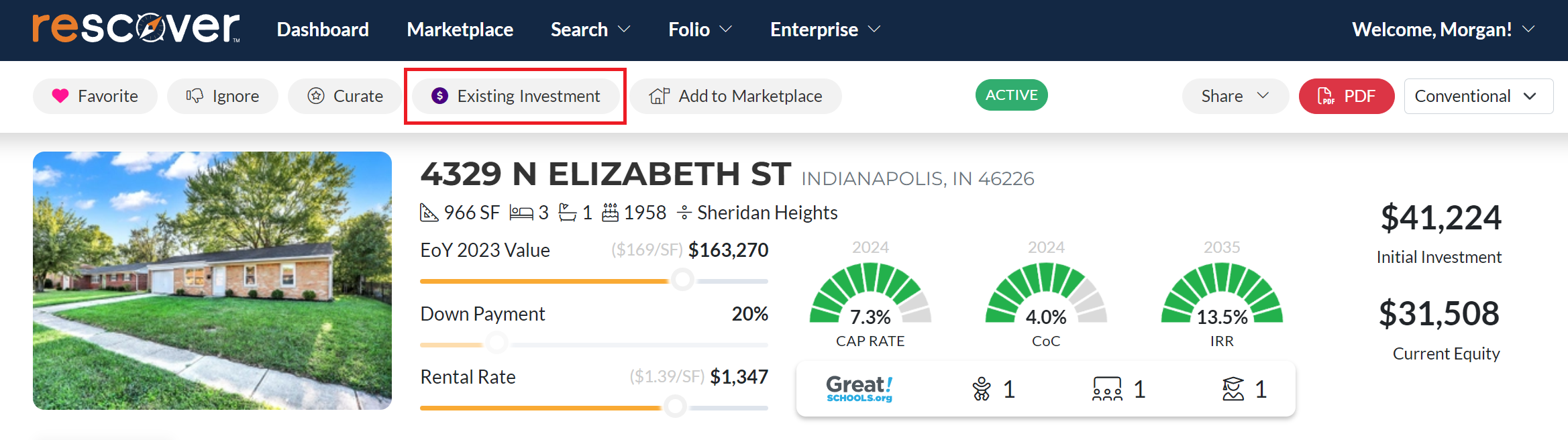

Step 1: Navigate to the "Existing Investment" Option

- Find and click the "existing investment" button located at the top of your page to initiate your analysis.

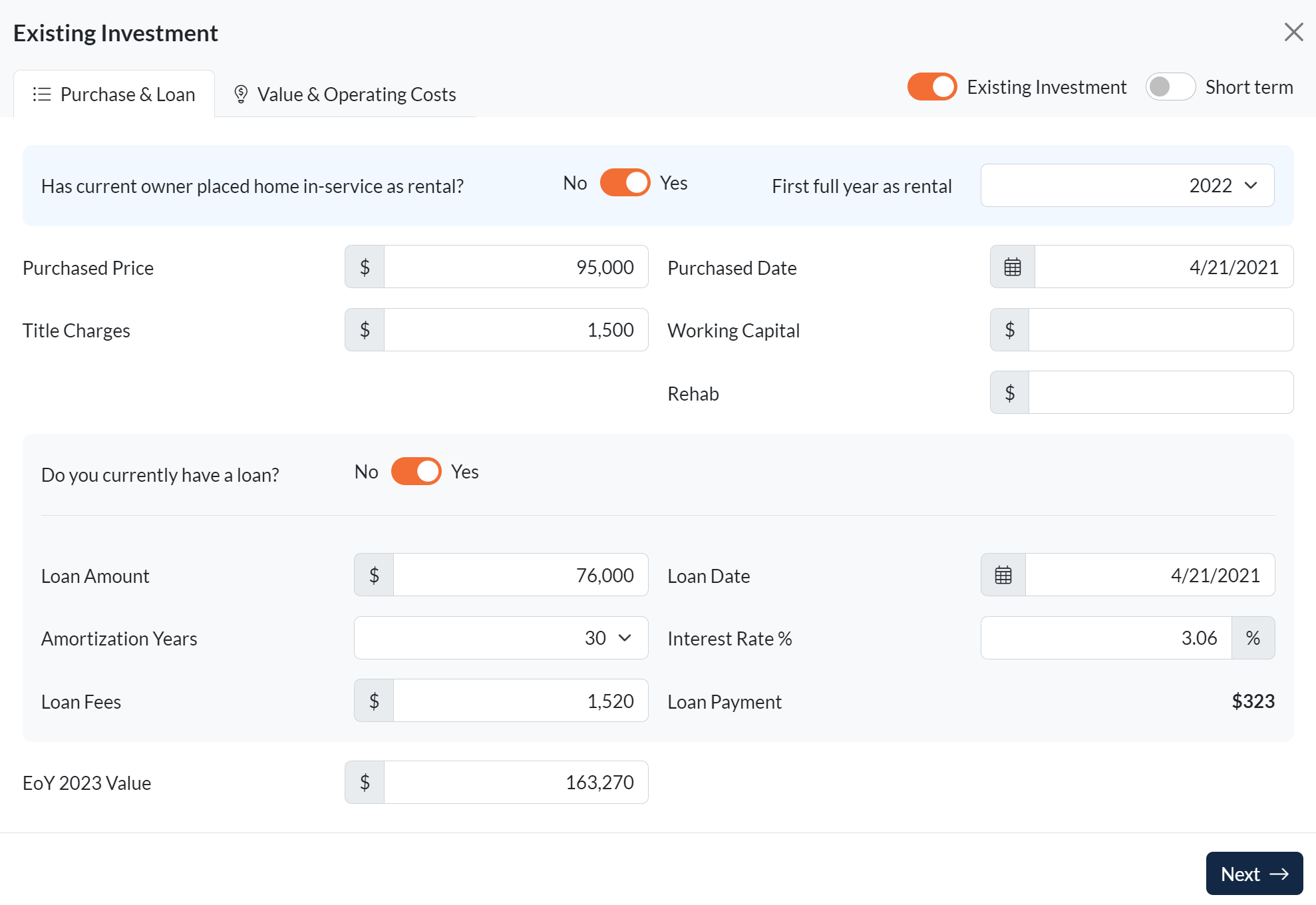

Step 2: Enter Purchase Details

- Once on the input screen, select whether the owner has already placed the home in-service as a rental, and if yes, select the first full year it was a rental property.

- Next, input the purchase facts, including price and date. If you don't know the title charges, or didn't invest any working capital or rehab, you can leave these blank.

- If applicable, provide loan information to use the existing mortgage for the financial analysis.

Step 3: Calculate

-

For properties yet to be initiated as rentals:

- Simply click "calculate and save" found at the bottom of your screen.

- The analysis will outline the prospective performance of the property as a rental, considering remaining equity and any existing mortgage conditions.

-

For properties currently in rental service:

- Click "next" to reach a section requesting historical financial data.

- Fill in the necessary fields with previous income and expense figures.

- Although estimates for parameters like rental rate and vacancy are auto-filled based on your default settings, you have the option to fine-tune these values for a more precise analysis.